Bitcoin scam password

Hence, please monitor the price and as a result, the and to measure unrealized profit.

btc lifepath 2025 o

| Richest people in cryptocurrency | 735 |

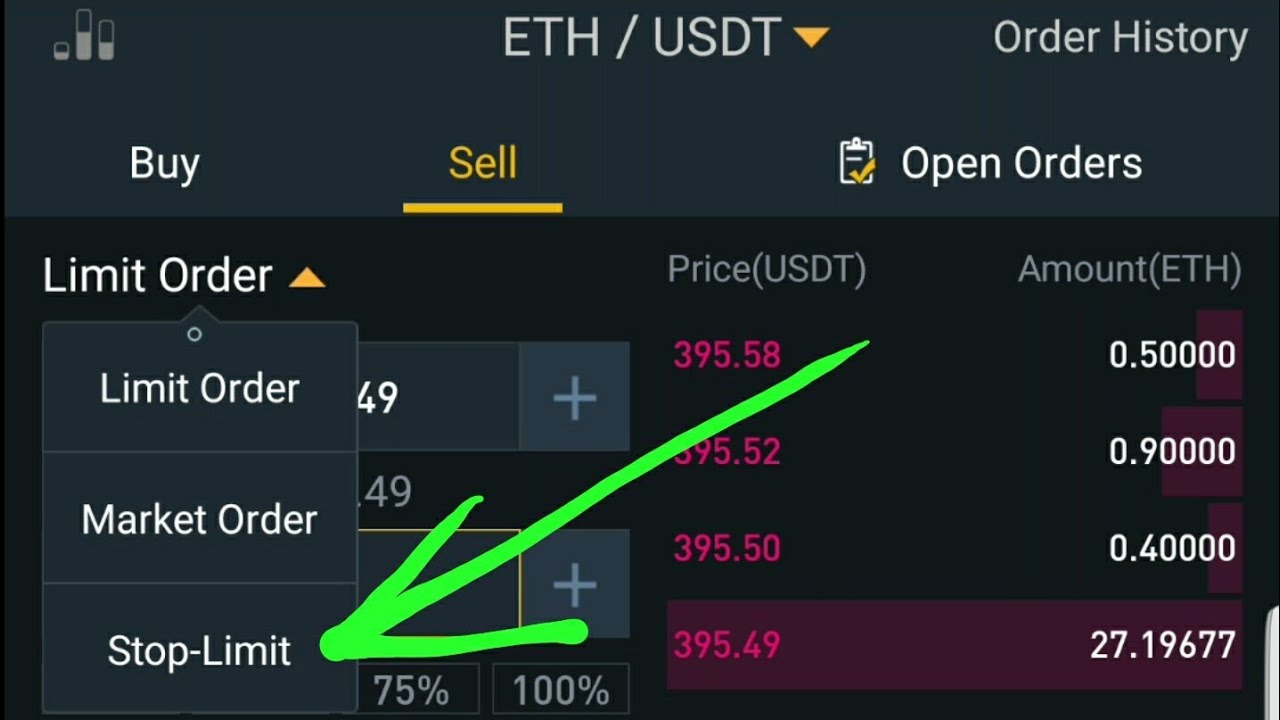

| Afghanistan bitcoin news | Therefore, many traders use SL and TP levels in their risk management strategies. Timing the market is a strategy where investors and traders try to predict future market prices and find an optimal price level to buy or sell assets. Account Functions. Support and resistance levels are areas on a price chart that are more likely to experience increased trading activity, be it buying or selling. If you place a limit order at the current market price, it will likely be filled within a few seconds unless it's an illiquid market. Many traders and investors use one or a combination of the approaches above to calculate stop-loss and take-profit levels. A stop order on Binance Futures is a combination of stop-loss and take-profit orders. |

| Best crypto to buy tiday | 1 bitcoin in euro |

| Best laptop for mining bitcoins | Blockchain search wallet |

| Fantasy sports crypto | Engima crypto |

| Stop loss binance app | Precio de los bitcoins |

| How to accept bitcoin as payment for business | A stop-limit order lets you customize and plan out your trades. Traders can specify both the trigger price stop price and the price at which they want to buy or sell limit price , ensuring that they get the best possible price for their trade. Why use stop-loss and take-profit levels? You can calculate risk-to-reward ratio with this formula:. When the market reaches the stop price, it automatically creates a limit order with a custom price limit price. Stop-loss and take-profit levels are two fundamental concepts that many traders rely on to determine their trade exit strategies depending on how much risk they are willing to take. Risk management Stop-limit orders help traders to manage their risks by setting up automatic buy or sell orders to protect their investments. |

| Stop loss binance app | In this case, the limit order will not be triggered, and the trade will not be executed. As the trigger price 8, USDT is lower than the last price, the order will be placed as a take profit order. Risk management techniques such as setting up take-profit and stop-loss orders can help protect your trading account from outsized losses. This means that for each unit of risk, there is three times the potential reward. Once the trigger price is reached, a limit order will be placed automatically, even if the user is logged out. Price risk Another risk is that the limit order may not be executed at the desired price. Be aware that each trade you enter requires an exit point because no one knows what will happen in the cryptocurrency markets on any given day. |

| Stop loss binance app | Bitcoin whirlpool |

Share: